Graduating in May with a degree in hand, our seniors will be embarking on their next great adventure, starting with the dreaded job search. With the economy in a slump for the past years due to the economic recession, this might seem like a less than thrilling prospect for most seniors.

However, the unemployment rate in the U.S. is the lowest it has been in the past three years. According to TradingEconomics.com the unemployment rate has been at 8.3 percent since February. More companies are hiring now, and people are leaving their jobs not due to layoffs, but for deliberate reasons, such as retirement.

“Employers overall added 227,000 jobs last month, powered by robust gains in healthcare, manufacturing and business services,” wrote Don Lee in a March 9 article in the Los Angeles Times. “Job growth over the last three months has averaged 245,000 a month — about 100,000 more a month than in the previous year, the Labor Department said Friday.”

With these encouraging statistics, our seniors should be hopeful as they begin to think about finding a job for themselves.

Guilford senior Elizabeth Fisher has already been looking for a job for after graduation.

“My main concern is finding paying jobs,” said Fisher. “I luckily have somewhere to live without paying for some time, but beyond short summer jobs and unpaid internships, I haven’t been able to find paying jobs in the fields I’m interested in.”

This, however, has much less to do with the actual job market than it does with the normal difficulties of finding a job without much previous working experience.

“I don’t have previous experience,” added Fisher. “It’s a really vicious circle where you can’t get a job without experience and you can’t get experience without a job or internships that don’t actually pay.”

This is a common occurrence for many graduates who are looking for a job for the first time. Employers are more likely to hire someone with prior working experience.

Internships and summer jobs are one way of building that résumé and getting hired after graduating from Guilford.

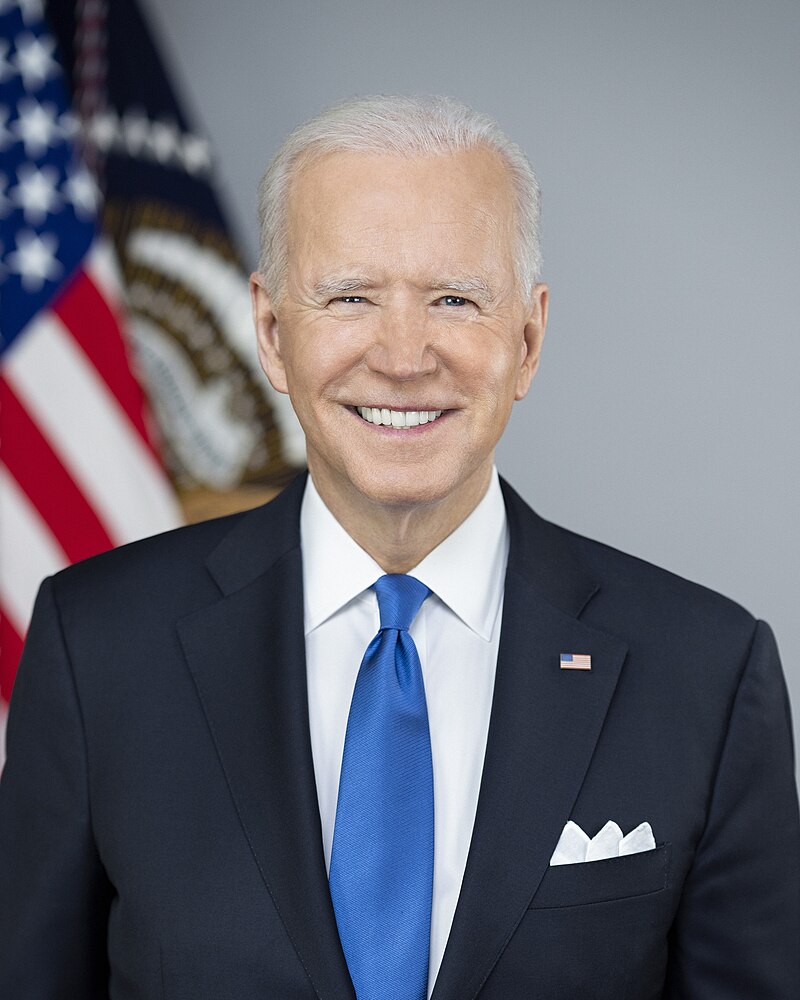

President Obama himself has been working hard to further improve the employment rate for the U.S. and, more specifically, for the younger generations currently searching for jobs.

“President Obama urged the private sector to create around 250,000 positions for students and youths by this summer,” wrote Joshua R. Weaver in The Root.

“Thirty-five companies pledged commitment to the initiative on Jan. 5, when President Obama announced the White House’s Summer Jobs+ program, and more companies are following suit — including many in the technology industry,” wrote Weaver.

This is another ray of light for the many college graduates anxiously contemplating their future and source of income. With this program, graduates are even more likely to find jobs and internships.

“America’s young people face record unemployment, and we need to do everything we can to make sure they’ve got the opportunity to earn the skills and a work ethic that comes with a job,” said Obama in a press release.

Daniel McCurdy • Mar 31, 2012 at 1:56 pm

This is an article by Dean Baker. It is very relevant to your reporting.

The Economic Recovery Fad

By Dean Baker

Economists and economic reporters are about as quick to change their assessments of the economy as teenagers shift allegiances among the latest pop star. While the economy rarely undergoes rapid shifts in direction, the public could be excused for not recognizing this fact based on economic reporting.

Unfortunately, the analyses that look at underlying trends to determine the future course of the economy are the exception. More typically, reporting amplifies the latest report and ignores other evidence about the likely future direction of the economy.

The latest fad is the strengthening recovery. The February jobs report was undoubtedly good news. It showed that the economy created 227,000 jobs in the month. Upward revisions to the prior two months brought the three-month average to 245,000, the best job growth of the upturn excluding temporary Census jobs in 2010.

The strengthening recovery fad followers also point to the rising stock market, which is now approaching its highest levels of the recovery after slumping last summer. With the economy now creating jobs at a healthy rate and the stock market on a steady upswing, what could be better?

It’s hard to believe that just six months ago the media were obsessed with forecasts for a double-dip recession. At the time the economy had been growing slowly, but there were good reasons for believing that growth would be picking up. Most importantly the drag from the winding down of stimulus was coming to an end. Nonetheless, talk of a double-dip became the centerpiece of many discussions of the economy at the time.

Today the tide has turned again, with the media largely ignoring warning signs that the path forward may not be all that rosy. First, it is worth noting that the 3.0 percent GDP growth of the 4th quarter was driven largely by inventory accumulations. Final demand grew at just a 1.1 percent annual rate in the 4th quarter. Inventories will not provide anywhere near the same boost to growth in the first quarter of 2012 or the year as a whole.

A second source of concern is the sharp falloff in capital goods orders and shipments reported for January. The relatively strong performance of this component of investment had provided an important boost to growth over the last two years. If equipment investment were to flatten or even decline it could knock as much as percentage point off the growth rate compared with its 2011 contribution.

A third basis for concern is the rising trade deficit. The same day that the wildly touted jobs numbers came out, we also got a disturbing report on the January trade numbers. The trade deficit increased by $2.2 billion in January. It is now running at annual rate of $630 billion, or 4 percent of GDP. This rise in the trade deficit will be another source of drag on growth, likely reducing the first quarter rate by more than half of a percentage point.

Finally, the January consumption data showed no real growth for the second-consecutive month. This indicates that consumption growth is likely to be very weak for the quarter. With wages not keeping pace with inflation, it is difficult to see how the economy can sustain strong consumption growth in 2012.

For these reasons, it would be foolish to paint too rosy a picture on the recovery. The economy will almost certainly keep growing. Both residential and non-residential construction will be positives in the year ahead. Also, with most of the state and local cutbacks already having been made, this sector may be a small positive in coming quarters as well. And consumption will grow, even if the pace is slow. However, we are likely to see somewhat slower growth in both output and jobs than what we have been seeing over the last few months.

It is also important to keep the current growth in perspective. This is an economy that is still down by close to 10 million jobs from its pre-recession level. Output is roughly 6 percent below potential. Even if the economy creates 250,000 jobs a month and grows at a 3.0 percent annual rate, it will be close to the end of the decade until we are back to our trend path. That is not a happy story, since tens of millions of people will needlessly suffer in the meantime.

And, we should always remember that it can be otherwise. If we generated jobs at the same pace as we did following the recessions in 1974-75 or 1981-82, the economy would be creating over 400,000 jobs a month. The reason that we are not creating

–This article was originally published on March 12, 2012 by The Guardian Unlimited.

Daniel McCurdy • Mar 30, 2012 at 8:54 pm

Yes, the jobs growth numbers were definitely better than what we were previously seeing. However, this needs to be put in the context of other recoveries.

During the last four years before the dot.com bubble burst in the 90’s, jobs increased by an average of 250,000 jobs a month. This is before the crisis hit. According to Dean Baker from the Center for Economic and Policy Research, “coming off a severe downturn we should be seeing jobs growth of 400,000 a month, as we did following the 81-82 recession and the 74-75 recession.”

This just points to the fact the government is not doing enough to get the economy going again, and the hope the the private sector will all of a sudden start its engines and start hiring workers like crazy without growth in demand is absurd.

What we should be concentrating on is not passively writing about small improvements in jobs numbers, but on informing students about the bigger picture reality.